Portfolio Manager

Chris Wain-Lowe, BA, MBA

Executive Vice-President and Portfolio Manager

Chris Wain-Lowe has 35 years of business management and global financial services experience – living and working in four continents: Europe, Asia, Africa, North America as well as the Caribbean, which also embraced corporate experience in the energy, natural resources and utility industries.

Income Matters Fund Details

Performance

As at July 31, 2025

| Series Start Date | Net Asset Value Per Unit (as at July 31, 2025) |

Monthly Distribution | |

|---|---|---|---|

| Portland Private Income Fund - Series A | Feb. 28, 2013 | $35.8584 | $0.3333 |

| Portland Private Income Fund - Series F | Jan. 7, 2013 | $37.6602 | $0.3750 |

| Portland Private Income Fund - Series AP | Dec. 31, 2018 | $10.0000 | $0.0308 |

| Portland Private Income Fund - Series FP | Jun. 29, 2018 | $10.0000 | $0.0392 |

| Portland Private Income Fund - Series A (USD) | Nov. 29, 2019 | $25.8794 | $0.2405 |

| Portland Private Income Fund - Series F (USD) | Nov. 29, 2019 | $27.1797 | $0.2706 |

| Portland Private Income Fund - Series AP (USD) | Jan. 31, 2020 | $7.2171 | $0.0223 |

| Portland Private Income Fund - Series FP (USD) | Jan. 31, 2020 | $7.2171 | $0.0283 |

| Year to Date | 1 Month | 3 Months | 1 Year | 3 Year* | 5 Year* | 10 Year* | Since Inception* | |

|---|---|---|---|---|---|---|---|---|

| Portland Private Income Fund - Series A | 2.18% | 0.34% | 0.77% | 6.06% | (0.12%) | 4.08% | 5.45% | 5.93% |

| Portland Private Income Fund - Series F | 2.87% | 0.43% | 1.06% | 7.30% | 1.04% | 5.28% | 6.66% | 7.19% |

| Portland Private Income Fund - Series AP | 2.18% | 0.31% | 0.93% | 3.76% | 3.76% | 3.27% | - | 3.32% |

| Portland Private Income Fund - Series FP | 2.77% | 0.39% | 1.18% | 4.80% | 4.80% | 4.30% | - | 4.38% |

| Portland Private Income Fund - Series A (USD) | 6.00% | (1.39%) | 0.26% | 5.68% | (2.71%) | 3.38% | - | 3.27% |

| Portland Private Income Fund - Series F (USD) | 6.72% | (1.30%) | 0.55% | 6.92% | (1.58%) | 4.57% | - | 4.46% |

| Portland Private Income Fund - Series AP (USD) | 6.00% | (1.42%) | 0.42% | 3.39% | 1.07% | 2.57% | - | 2.38% |

| Portland Private Income Fund - Series FP (USD) | 6.62% | (1.34%) | 0.67% | 4.43% | 2.08% | 3.60% | - | 3.40% |

Fund Information by Series

The NAV for the Portland Private Income Fund is expected to be released within 12 business days after the month end.

| Common Units | Preferred Units | |||

|---|---|---|---|---|

| A | F1 | AP | FP1 | |

| Min. initial investment, accredited investors2 | $2,500 | $2,500 | $5,000 | $5,000 |

| Min. initial investment, non-individuals | $150,000 | $150,000 | $150,000 | $150,000 |

| Min. subsequent investment3 | $500 | $500 | $500 | $500 |

| Management fee4 | 0.50% | 0.50% | 0.50% | 0.50% |

| MER5 | 2.05% | 0.88% | 0.00% | 0.00% |

| Trailer fee | 1.00% | – | 1.00% | – |

| Distribution | $4.00 | $4.50 | $0.370 | $0.470 |

| Redemption fee | Within 18 months - 5% 19-36 months - 2% |

None | ||

| Risk Rating | Medium | Low-to-Medium | ||

4 Strong Pillars of Assets

We believe that we have better positioned and shaped the Fund’s future by providing two discrete offers to investors: the common units and preferred units; supported across four strong pillars of assets: Canadian mortgages, Canadian commercial loans, Global maritime loans and Global infrastructure assets and operating leases as shown in the Figure below.

When creating this Fund, we wanted to build a portfolio that could straddle a variety of investment opportunities, be nimble and adapt to changing circumstances and align to the best opportunities within those circumstances, while delivering steady income distributions and a stable NAV. From 2013 to mid-2015, we selected a portfolio almost exclusively of private mortgages. Beginning in mid-2015, we gradually assessed the attractiveness of the housing market compared to other lending opportunities and selected four Specialty Investment Managers to enable the Fund to take advantage of those opportunities in order to ensure the Fund’s monthly distribution was supported by the four strong pillars of asset classes that are diversified by sector and geography.

- Crown Private Credit Partners Provides a $40 Million Senior Term Loan to MDT Sporting Goods Ltd.

- EnTrust Global Completes Acquisition of Maas Capital From ABN AMRO. Portfolio includes 15 equity joint ventures across shipping, intermodal and offshore.

- Crown Capital Partners Inc. (“Crown”) announced that Crown Capital Partner Funding, LP (“Crown Partners Fund”), an investment fund of which it owns an effective interest of approximately 28% (and of which Portland Private Income LP owns an effective interest of approximately 18%) has received the full repayment by T5 SC Oil and Gas Limited Partnership (a privately held, Calgary-based petroleum and natural gas company) of its $27.0 million term loan from Crown Partners Fund, of which the first advance was completed in August 2018.

- Crown Private Credit Partners Inc. continued its partnership with CareRx, the leading provider of pharmacy and other healthcare services to Canadian seniors (TSX: CRRX) by providing CareRx with a $60 million senior term loan.

- Portland Private Income Fund Special Distribution 2020 for Year End

- Crown Capital Partners Announces Loan Repayment

- Crown Capital Partners Announces Repayment of Loan by Touchstone Exploration

- Portland Private Income Fund – March 31, 2020 Valuation Update

- Crown Partners Fund Completes Term Loan with Centric Health for up to $30 Million

- Portland Private Income Fund Decreases Distribution rates of Preferred Units to 2.45% for Series AP and to 3.45% for Series FP.

- Crown Partners Fund Completes $5.5 Million Term Loan with Internet Service Provider CCI Wireless

- Portland Private Income Fund Decreases Distribution rates of Preferred Units by 0.75%

- Crown Capital Partners Increases Rokstad Holdings Corporation Term Loan to $50 Million

- Crown Announces Two Follow On Investments into Existing Portfolio Companies

- Brookfield Super-Core Infrastructure Partners and Dominion Energy Announce the Cove Point Transaction

- Portland Private Income Fund to invest in Brookfield Infrastructure Fund IV

- Crown Capital Partners Completes $25 Million Term Loan with Rokstad Holdings Corporation

- Crown Capital Partners Announces Repayment of Loan by Baylin Technologies

- Crown Capital Partners Announces Repayment of Loan by Bill Gosling Outsourcing

- PORTLAND PRIVATE INCOME FUND to invest in CROWN POWER FUND

- PORTLAND PRIVATE INCOME FUND to invest in BROOKFIELD SUPER-CORE INFRASTRUCTURE PARTNERS

- Crown Capital Partners Provides Additional $5 Million to Triple Five Intercontinental Group Ltd.

- Crown Capital Partners Completes Term Loan with VIQ Solutions Inc. for up to $15 Million

- Crown Capital Announces Repayment of Loan by Marquee Energy Ltd.

- Portland Private Income Fund Increases Distribution of Preferred Units

- Crown Capital Partners Completes $15 Million Term Loan with Triple Five Intercontinental Group Ltd.

- Crown Capital Announces Repayment of Petrowest Loan.

- Crown Capital Partners Completes $12.0 Million Term Loan with DATA Communications Management Corp.

- Crown Capital Partners Announces $8.0 Million Term Loan with Canadian Helicopters Limited.

- Crown Capital Partners Announces $7.0 Million Term Loan with Active Exhaust.

- Crown Capital Announces Repayment of Loan by Medicure Inc.

- Crown Capital Provides Update on Petrowest Loans.

- Crown Capital Fund IV, LP looks to acquire profitable operating divisions from existing debtor.

- Crown Capital Fund IV, LP completes $25 million loan with Ferus Inc.

- Crown Capital Fund IV, LP restructures debt financing with Petrowest.

- Crown Capital Fund IV, LP completes $30 million loan with a Canadian oil and natural gas company.

- Crown Capital Fund IV, LP completes a $15 million term loan with a growing Alberta based business.

- Crown Capital Fund IV, LP completes a $60 million term loan with a Canadian specialty pharmaceutical company.

- Crown Capital Fund IV, LP completes a $15 million term loan with one of the largest independent onshore oil producers in Trinidad and Tobago.

- Crown Capital Fund IV, LP completes $15 million deal with Canadian customer contact solution services company eyeing growth in Asia.

- Crown Capital Partners Inc. completes its first loan under its Long-term Financing solutions line of business.

- Crown Capital Fund IV, LP closes its second energy deal as part of a $130 million senior secured first lien note offering.

Fund Details

| Fund Net Assets | $143.0 million |

| Inception Date | January 7, 2013 |

| Fund Type | Alternative Strategies |

| Offer document | Offering Memorandum |

| Legal type | Mutual Fund Trust |

| Eligible for registered plans | Yes |

| Eligible for PAC Plans | Yes, monthly minimum of $500 |

| Purchases and redemptions | Monthly |

| Notice period for redemptions | 60 days |

| Minimum investment term | None |

How The Fund is Managed

The Fund will invest all, or substantially all, of its net asset into the Portland Private Income LP (the “Partnership”) which invests primarily in a portfolio of private debt instruments, debt instruments and debt-related securities including commercial mortgages and private debt.

Keystone Investments:

-

Real Estate debt; primarily first mortgage floating-rate loans, asset backed on properties being developed and constructed across North America.

-

Senior secured cash flow lending; to mid-market companies in North America and Europe.

-

Maritime assets; primarily senior secured floating-rate loans to global shipping and other maritime businesses.

-

Infrastructure assets; core infrastructure, long duration assets with regulated/contracted revenues.

-

Invest in complementary income producing public securities, including real estate income trusts, royalty income trusts, preferred shares, dividend paying equity securities and debt securities including convertibles, corporate and sovereign debt.

-

The Fund has issued a preferred class of units to provide an additional source of borrowing. The Fund may from time to time borrow from the issuance of preferred units, a bank, prime broker, the Manager or its affiliates up to 25% of the total assets of the Partnership.

-

Preservation of capital

-

Provide income

-

Above average long-term returns

Investment Objective

Key Reasons To Invest

Capital Preservation

-

By focusing on relatively lower risk strategies, the risk of capital loss is reduced.

Income

-

Focus on investments that pay predictable interest payments.

Liquidity

-

Focus on investments with 6 months to 10 years time horizons with interest payments providing additional liquidity in the interim.

Reduced Market Risk

-

Shorter time horizon investments with pre-determined liquidity events are less sensitive to movements in interest rates and market prices.

Access

-

Overcome the barriers that typically prevent individuals from investing in private investments:

-

High minimum investments;

-

Inadequate diversification; and

-

Additional due diligence and monitoring.

-

The Offering

Units are being offered on a continuous basis to investors resident in the Provinces or Territories of Canada who (a) are accredited investors, (b) who invest a minimum of $150,000 in the Fund, or (c) to whom Units may otherwise be sold.

The Manager has designated three series of Common Units which are currently being offered:

-

Series A Units are available to all investors who invest a minimum of $2,500 and who meet the minimum investment criteria.

-

Series F Units will generally only be issued to investors who invest a minimum of $2,500, who purchase their Units through a fee-based account with their registered dealer and meet the minimum investment criteria.

-

Series O Units will be issued to certain institutional or other investors and who meet the minimum investment criteria.

The Manager has designated two series of Preferred Units which are currently being offered:

-

Series AP Units are available to all investors who invest a minimum of $5,000 and who meet the minimum investment criteria.

-

Series FP Units will generally only be issued to investors who invest a minimum of $5,000, who purchase their Units through a fee-based account with their registered dealer and meet the minimum investment criteria.

Please see the Offering Memorandum for fees and specific details on the offering.

Offering Memorandum Subscription AgreementPotential Risks

-

While the Manager exercises due diligence throughout the lending process, no guarantees can be given to offset a risk of loss and investors should consult with their financial advisor prior to investing in the Fund. The Manager believes that given the character of the private debt investments that are making up the majority of the Fund’s holdings, the Fund has less exposure to market risk than a similar fund invested in publicly listed securities. The Manager believes the following risks are key to the Fund’s performance: nature of investments, credit, interest rate, general economic and market conditions, liquidity, marketability and transferability of units. Please read the “Risk Factors” section in the Offering Memorandum for a more detailed description of the relevant risks.

Disclosure

* Annualized.

** Annualized, Series F common units

1 Generally available through dealers who have entered into a Portland Series F Dealer Agreement.

2 Accredited Investors as defined under National Instrument 45-106.

3 For investors who are not Accredited Investors, the additional investment must be in an amount that is not less than $500 if the investor initially acquired Units for an acquisition cost of not less than $150,000 and, at the time of the additional investment, the Units then held by the investor have an acquisition cost or a net asset value equal to at least $150,000, or another exemption is available.

4 See the offering memorandum for fee details.

5 MER or management expense ratio is as at December 31, 2024. MER is updated on a semi-annual basis. Expenses of the Preferred Units are allocated to unitholders of the Common Units as per the Fund’s offering documents.

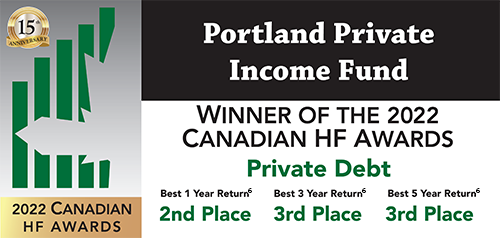

6 The Canadian Hedge Fund Awards are based solely on quantitative performance data of Canadian hedge funds with Fundata Canada managing the collection and tabulation of the data to determine the winners. There is no nomination process or subjective assessment in identifying the winning hedge funds. The 2018 awards were based on 207 Canadian hedge funds to June 30th, 2018; the 2019 awards were based on 197 Canadian hedge funds to June 30th, 2019; the 2020 awards were based on 221 Canadian hedge funds to June 30th, 2020, the 2021 awards are based on 226 Canadian hedge funds to June 30, 2021, the 2022 awards are based on 234 Canadian hedge funds to June 30, 2022, and the 2023 awards are based on 264 Canadian hedge funds to June 30, 2023. The Sharpe ratio is a measure for calculating risk-adjusted returns. The Sharpe ratio is the portfolio return in excess of the risk-free rate divided by the volatility of the portfolio.

The Portland Private Income Fund (the “Fund”) is not publicly offered. This fund is offered via an offering memorandum and is available under exemptions to investors who meet certain eligibility or minimum purchase requirements such as “accredited investors”. You will only be permitted to purchase Units if your purchase qualifies for one of these exemptions. A list of criteria to qualify as an accredited investor is set out in the subscription agreement delivered with the Offering Memorandum and generally includes individuals who have net assets of at least $5,000,000, or financial assets of at least $1,000,000, or personal income of at least $200,000, or combined spousal income of at least $300,000 in the previous two years with reasonable prospects of same in the current year, or an individual registered under the securities legislation of a jurisdiction of Canada as a representative of a registered adviser or dealer.

Information herein pertaining to the Fund is solely for the purpose of providing information and is not to be construed as a public offering in any jurisdiction of Canada. The offering of Units of the Fund is made pursuant to an Offering Memorandum and the information contained herein is a summary only and is qualified by the more detailed information in the Offering Memorandum.

Commissions, trailing commissions, management fees and expenses all may be associated with investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and does not take into account sales, redemptions, distributions or optional charges or income taxes payable by any securityholder in respect of a participating fund that would have reduced returns. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. The portfolio is expected to generate income from dividends, interest and option writing income, which after deduction of expenses, will be distributed by the Fund to unitholders. Assuming the expected level of income is received, the portfolio would not be required to appreciate. If the level of income is less than the amount necessary to meet the target distribution, the Manager may either pay out a lower distribution or supplement the amount needed through net realized capital gains from the portfolio or may return a portion of the capital of the Fund to unitholders in which case the distribution would not have been fully funded as the net asset value would be reduced. Distributions are reinvested automatically in additional units of the Fund. No commissions are payable upon automatic reinvestment of distributions.

Portland Investment Counsel Inc. ("Portland") has not independently verified all of the information and opinions presented on and through this page. The information presented on and through this page is provided as a general source of information, is not guaranteed to be current, accurate or complete, and is subject to change without notice. Portland accepts no responsibility for any loss or damage that results from any information contained on this page (including any data or information accessed by Portland through other sites and downloaded to this site) or accessed through other sites to which this page is linked. Portland makes no representations or warranties whatsoever about the data or information in any linked sites or accessed by Portland through other sites and downloaded to this page and specifically makes no representation that such data or information is accurate or complete. Information presented in this material should be considered for background information only and should not be construed as investment, tax or financial advice. Please consult a Financial Advisor. Every effort has been made to ensure the utmost accuracy of the information provided. Information provided is believed to be reliable when published. All information is subject to modification from time to time without notice. Consent is required for any reproduction, in whole or in part, of this piece and/or of its images and concepts. Portland Investment Counsel is a registered trademark of Portland Holdings Inc. The Unicorn Design is a trademark of Portland Holdings Inc. Used under license by Portland Investment Counsel Inc. Buy. Hold. And Prosper. is a registered trademark of AIC Global Holdings Inc. used under license by Portland Investment Counsel Inc.