December 15, 2025

Portland Investment Counsel Inc. Appoints Greg Dimmer as Senior Vice-President, Private Credit

Read moreOctober 30, 2025

Funds Managed by Portland Investment Counsel Inc. Win 6 Awards at the 2025 Canadian Hedge Fund Awards

Read moreMay 13, 2025

Portland Investment Counsel Inc. Announces Promotion of Dragos Berbecel as Chief Investment Officer

Read moreMarch 27, 2025

Portland Investment Counsel Inc. Announces Alternative Fund Risk Rating Changes

Read moreJanuary 7, 2025

Portland Investment Counsel Inc. Recognized at the FundGrade A+® Awards

Read moreNovember 11, 2024

Portland Investment Counsel Inc. Wins 2 Awards at the 2024 Canadian Hedge Fund Awards

Read moreJuly 5, 2024

Portland Investment Counsel Inc. Announces Termination of Portland Global Balanced Fund

Read moreJanuary 26, 2024

Portland Investment Counsel Inc. Announces Termination of Portland Global Alternative Fund

Read moreOctober 20, 2023

Portland Investment Counsel Inc. wins 5 awards at the 2023 Canadian Hedge Fund Awards

Read moreApril 26, 2023

Portland Investment Counsel Inc. Announces Termination of Portland North American Alternative Fund

Read moreApril 17, 2023

Portland Holdings Investco Limited and MBM Holding of Dubai sign an MOU

Read moreDecember 15, 2022

Ultra Safe Nuclear Corporation and Portland Holdings Sign an MOU

Read moreDecember 20, 2022

We are pleased to share that AIC Global Holdings Inc., a subsidiary of Portland Holdings Limited, has appointed Dr. Stephen Bushby as Chief Nuclear Officer.

Read moreSeptember 19, 2022

CNL and Portland Holdings Sign MOU

Read moreMay 2022

Change in Auditor Notice

Read moreNovember 2021

Portland Holdings appoints an International Business Development, Manager

Read moreNovember 2021

Portland Holdings Appoints Chief Medical Officer

Read moreNovember 2021

Portland Holdings Appoints Chief Scientific Officer

Read moreOctober 2021

Portland Holdings announces new strategic initiative

Read moreOctober 2021

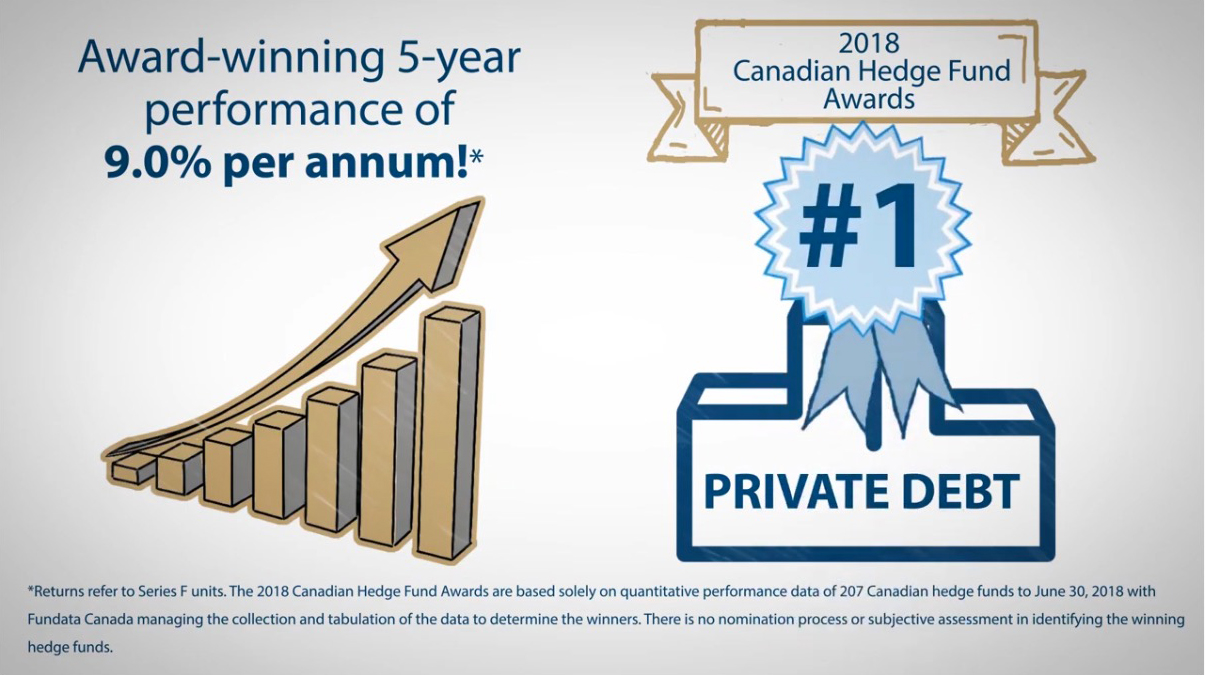

Portland Private Income Fund was recognized with two awards at the 2021 Canadian Hedge Fund Awards, the highest honour in Canada’s hedge fund industry

Read moreArchives

-

2020

-

2019

-

2018

-

2017

-

2016

-

2015

-

2014

-

2013

-

2012

-

2011

-

2010

-

2009

- Portland Investment Counsel Inc. Leads Investment in Telix Pharmaceuticals Limited via Private Placement

- Portland Private Income Fund to invest in Brookfield Infrastructure Fund IV

- Portland Holdings is pleased to announce that Michael Lee-Chin has been appointed to the supervisory board of ITM Isotopen Technologien München AG (“ITM”)

- Portland Investment Counsel Inc. Announces Mutual Fund Risk Rating Change For Some of its Mutual Funds.

- Portland announces a new relationship with Brookfield Asset Management Inc., one of the largest global infrastructure investors and operators with over $100 billion of infrastructure assets under management.

- Portland Global Income Fund Announces a Redesignation of Units and Lowering of Series F Annual Management Fees

- Portland Investment Counsel Inc. (Portland) is pleased to announce that Portland Private Income LP (PPILP) has completed a co-investment with one of its Specialty Investment Managers, Crown Capital Partners Inc. (Crown) (TSX: CRWN). Crown announced the closing of a $33.0 million term loan (the Agreement) to Baylin Technologies Inc. (Baylin) (TSX: BYL), a global provider of innovative wireless antenna solutions with over 39 years of experience in designing, manufacturing and supplying antennas for the wireless infrastructure, networking and mobile markets.

- Portland Investment Counsel Inc. (Portland) is pleased to announce that Portland Special Opportunities Fund and Portland Value Plus Fund to invest in EnTrustPermal’s Special Opportunities Strategy

- Portland Investment Counsel Inc. (“Portland”) is pleased to announce a new relationship with one of the world’s largest global hedge fund businesses, EnTrustPermal. Portland Private Income Fund, an investment fund managed by Portland, has initiated an investment in a maritime lending fund managed by EnTrustPermal.

- Crown Capital Partners Announces $8.0 Million Term Loan with Canadian Helicopters Limited

- Crown Capital Announces Repayment of Loan by Medicure Inc.

- Crown Capital Provides Update on Loans to Petrowest Corporation and Acquisition of Civil Assets

- Crown Capital Partners Announces $25 Million Term Loan with Ferus Inc.

- Crown Capital Partners Announces Amended Debt Agreement and New Bridge Loan Financing with Petrowest Corporation

- Crown Capital Partners Announces $30 Million Term Loan with Marquee Energy Ltd.

- Crown Capital Partners Announces $15.0 Million Term Loan with Solo Liquor

- Newlook Capital Industrial Services Fund announces acquisition of MultiGas Detection and Instrumentation Services Ltd./a>

- Portland Global Energy Efficiency and Renewable Energy Fund LP to invest in Newlook Capital Industrial Services LP

- Newlook Capital Industrial Services LP announces first quarter distribution and acquisition of shares in Direct Elevator Acquisition Company Ltd.

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

- Crown Capital Announces $15.0 Million Investment in Senior Secured First Lien Notes Offering by Source Energy Services

- Crown Capital Partners Completes $60.0 Million Term Loan with Medicure Inc.

- Crown Capital Signs $15.0 Million Term Loan with Touchstone Exploration

- Crown Capital Completes $15 Million Term Loan with Bill Gosling Outsourcing

- Crown Capital Completes $25 Million Term Loan with PenEquity Realty Corporation

Media

Last fall took a big position in TD Bank: Cole

James Cole, Senior Vice President at Portland Investment Counsel, joins BNN Bloomberg to discuss investing through market uncertainty and volatility.

Wealth Professional: PM reflects on four decades behind the desk

Wealth Professional – James Cole might have been destined to be a portfolio manager. The son of a portfolio manager and the grandson of an executive on the Toronto Stock Exchange, this industry was in Cole’s blood. Growing up around investment pros he saw the unique combination of rational, mathematical analysis and emotional management that defines successful investing.

WPTV: Most advisors 'don't have a value system' to create wealth

James Burton, managing editor of Wealth Professional Canada, sits down with renowned investor Michael Lee-Chin, chairman and CEO of Portland Holdings, to discuss recent market volatility, how he’s investing in the future, and why now is the ideal time to revisit the principles of wealth creation.

Evolve Magazine: Framework for Wealth Creation

Our Executive Chairman, Michael Lee-Chin shares a powerful framework for building lasting wealth in his first Evolve Magazine article

Hear why Michael Lee-Chin is investing in atomic technologies

Our Executive Chairman, Michael Lee-Chin sat down with David Kitai of Wealth Professional for a conversation on why he feels nuclear is poised to be the next big investment opportunity.

Why mankind's core challenges have Michael Lee-Chin looking at the atom

Wealth Professional - As the need grows to clean our energy grids and treat cancers the legendary businessman is looking at how nuclear technologies can offer solutions and investment upside

Billionaire Michael Lee-Chin’s 18 rules to creating long-term wealth

Financial Post - Michael Lee-Chin, who takes Warren Buffett as his role model, urges investors to consider the power of time and compounding

Michael Lee-Chin: Speaks at the Canadian Club Toronto

Join Canadian Club Toronto as they hosted Michael Lee-Chin, CEO of Portland Holdings Inc. and one of Canada’s most successful investors and entrepreneurs. As a self-made billionaire, Mr. Lee-Chin shares his journey and valuable insights into the world of wealth creation.

VIDEO

PODCAST

Michael Lee-Chin: On Power and Precision

A mind driven by curiosity—and a certain kind of fear—can engineer a path around virtually any challenge, making the presumed limits to achievement immaterial.

BNN: Billionaire Michael Lee-Chin on investing in nuclear power

Michael Lee-Chin, businessman, investor and philanthropist, joins BNN Bloomberg to discuss his journey in investing in renewable energy.

Can the uranium bull market keep its new glow?

The spot price for uranium almost doubled since early 2023. Can this trend continue?

WP: Why Michael Lee-Chin is investing in nuclear power

Billionaire advisor and entrepreneur says the same principles that he used to build his wealth have dictated a focus on nuclear energy

WP: Why Michael Lee-Chin collaborated with MBM Holding of Dubai

Billionaire investor, and former advisor, outlines why he’s working with the Emirati holding company, and what that should mean for advisors

WP: Michael Lee-Chin

Why advisors should care about the existential threats to mankind

Michael Lee-Chin

‘Titan of Jamaican business’ inducted into PSOJ Hall of Fame

Michael Lee-Chin

Tackling the world's most urgent needs

CNL and Portland Holdings Sign MOU

Addressing the World’s Climate and Health Challenges

Michael Lee-Chin

Veteran investor Michael Lee-Chin on what he is looking for in 2022

OncoBeta

Michael Lee-Chin backs company that offers single-session keloid treatment

Canadian Hedge Fund Award Winners!

Portland Investment Counsel Inc. is pleased to announce that two of its funds were recipients of awards at the 2020 Canadian Hedge Fund Awards, an honour in Canada’s hedge fund industry. Portland funds were winners in 2 of the 5 categories.

A Steady Hand

Portland Investment Counsel portfolio manager James Cole, whose funds have won several awards, shares the investment philosophy that’s steered him through his 37-year career.

More Awards for Portland!

Portland Focused Plus Fund LP wins at the 2019 Canadian Hedge Fund Awards

Goodman to Honour Visionary Entrepreneur Michael Lee-Chin

Prominent entrepreneur Michael Lee-Chin has been selected as the Goodman School of Business 2019 Distinguished Leader.

Videos

The Portland Difference

Private Investing 101

Advice in times of market volatility with James Cole

The benefits of alternative investments with James Cole

Understanding Agency Risk with James Cole

News Archives

-

2020

-

2019

-

2018

-

2017

-

2016

-

2015

-

2014

-

2013

-

2012

-

2011

-

2010

-

2009

- Portland Investment Counsel portfolio manager James Cole, whose funds have won several awards, shares the investment philosophy that’s steered him through his 37-year career.

ARTICLE - PCMA Award Winner!

ARTICLE - Portland Focused Plus Fund LP wins at the 2019 Canadian Hedge Fund Awards

ARTICLE - Goodman to honour visionary entrepreneur Michael Lee-Chin

ARTICLE

- Michael Lee-Chin Appointed to Order of Ontario The Order of Ontario recognizes individuals whose exceptional achievement in their field have left a lasting legacy in the province, in Canada and beyond.

Press Release

Video

- Portland Canadian Balanced Fund wins FundGrade A+ Award

ARTICLE - Portland Canadian Balanced Fund wins FundGrade A+ Award

ARTICLE

-

Democratizing opportunities for investors

ARTICLE - Portland Focused Plus Fund LP Wins the 2017 Private Capital Market Association (PCMA) Investment Fund Award

ARTICLE - Michael Lee-Chin teams up with Lanterra for 42-storey Toronto condo

PART 1

PART 2

- Award-wining fund manager James Cole explains how to navigate through periods of market volatility

- Autocratic leadership works if you follow these five guidelines

- Rules of Wealth - Michael Lee-Chin extols the importance of having a good mix of liquid and illiquid assets in your portfolio

All articles and videos

- Michael Lee-Chin appointed the Chairman of the Government of Jamaica’s Economic Growth Council (EGC)

All articles and videos

- Why do the CPP's investments look nothing like your RRSP?

- Ontario Teachers CIO: We Want 64% or So in Private Assets

- Why wealthy families lose their fortunes in three generations

- A world awash in private equity The global private equity market is experiencing a major resurgence. “The world right now is awash in private equity money,” says Cameron Belsher, leader of the mergers and acquisitions group with McCarthy Tétrault LLP

- OMERS Sees `Enormous' Opportunities Beyond Stock, Bond Investing

- Investment Executive - Lee-Chin’s plan to ensure your wealthy clients’ children stay that way

- Wealth Professional Magazine - A profile of Michael Lee-Chin

- Financial Post - To build and maintain wealth, invest like the wealthy - Michael Lee-Chin

- Award Winning Portland Private Income Fund

- Michael Lee-Chin recognized with Lifetime Achievement Award

- Michael Lee-Chin receives the A.G. Gaston Lifetime Achievement Award

- Laurier appoints Chancellor Michael Lee-Chin to second term

- Portland’s Michael Lee-Chin to win PE bet with $3 bln sale of Columbus

- Michael Lee-Chin and Family Donate $10M in support of Joseph Brant Hospital

- The mutual fund guru told a select audience of business people and other folks with money to invest Tuesday evening that following five simple rules can help them turn modest wealth into the kind others envy.

- His Burlington-based Portland Holdings owns plenty of big-ticket items — including resorts, TV stations, a bank and numerous financial services providers. He says he loves the challenges of working in what he calls the world’s most dynamic industry — investing — but loves the generosity that money affords him even more.

- Wealthy Investors Want More Private Equity - While the affluent population has always invested in privately held firms, interest in private equity as an asset class has surged in recent years prompting a commensurate response from the financial community.

- Cover Story: "Wealth Can Be Created" The Return of Michael Lee-Chin - Renowned billionaire Michael Lee-Chin has a vision. It’s a vision tied to a philosophy, he says, and has always been at the heart of his many businesses and at the root of his prosperity. - Wealth Professional Magazine

- The Portland Global Energy Efficiency and Renewable Energy Fund LP was celebrated as the ‘Investment Fund Deal of the Year’ for providing investors with a unique opportunity to invest alongside supranational institutions and sovereign states in a renewable energy investment strategy.

- BLOOMBERG - Banks Bet on Wealth to Counter Weary Consumers

- Ontario Municipal Employees Retirement System has posted a 10 per cent return on investments last year, led by private equity and real estate.

- CNBC - These pension funds made a killing with private equity

- Yale Daily News - Investments Office continues to push private equity

- Private Equity: How the Rich Stay That Way: Tiger 21 Investment Allocation Index shows high net worth investors seek security and income, while limiting exposure to public equities.

- The Globe & Mail - CPPIB’s active investment plan scores big with 16.5% rate of return

- ADVISOR.CA - PRIMER ON PRIVATE EQUITY - If your wealthy clients haven't considered private equity, they should. It's uncorrelated to the stock market and has potential for outsized returns.

- The New York Times - The Case Against Too Much Independence on the Board

- The Globe and Mail - Private equity rewards investors with time and patience

- The Globe and Mail - How the Big Six banks won the battle for Canadians’ wealth

- TIGER 21’s - Ultrawealthy Investors Beef Up Private Equity Allocation

- The Wall Street Journal - Piling Into Private Equity

- Yale Daily News - Investments Office continues to push private equity

- Investment Executive - Michael Lee-Chin is back with private equity and mutual funds.

- Private Equity: How the Rich Stay That Way - Tiger 21 Investment Allocation Index shows high net worth investors seek security and income, while limiting exposure to public equities.

- Ultra-wealthy look to Ivy League endowment funds for investment lessons - This Financial Post article relates that the needs of retail and wealthy investors are the same, and so the asset mix should also be the same.

- October, 2012: Canadian Business Magazine - Round 2 for Michael Lee-Chin

- July, 2012: Private Wealth Magazine - A feature article on Michael Lee-Chin in "Private Wealth Magazine" considering himself himself a “statistical improbability.”

- June, 2012: Secrets of the Ultra Wealthy - Portland firmly believes that if the needs of retail and wealthy investors are the same, the asset mix should also be the same.

- June, 2012: Democratizing Wealth Creation - The Globe and Mail writes: "The new twist to Portland’s venture is that of giving retail investors a way to own a piece of private companies."

- September 21, 2011: Chris Wain-Lowe - “The price-to-book comparison is out of line,” said Chris Wain-Lowe, who oversees about $200 million of financial shares at Portland Investment Counsel Inc. in Burlington, Ont. “If an investor has a two-plus-years outlook, when we believe banking will get back to more normal earnings levels, there’s far greater uplift in holding a well-diversified global bank than a Canadian bank.”

- March 3, 2011: Michael Lee-Chin - At the Barbados International Business Association (BIBA), Mr. Lee-Chin describes the business of democratizing formerly inaccessible opportunities in order to make it possible for every investor to build a portfolio no different from the wealthy.

- February 20, 2011: Stock funds that have stood the test of time - Manulife Advantage Fund, managed by Michael Lee-Chin.

- November 4, 2010: Michael Lee-Chin - A global economic recession, unpredictable weather-related disasters and a tightening global regulatory regime are some of the adversities being faced by the corporate Caribbean. So an impassioned and personalised presentation by self-made Jamaican billionaire Michael Lee Chin on “How to Persevere in Times of Adversity”, at the recently concluded International Business Week 2010 Conference at the Hilton Barbados came at the right time for many.

- August 9, 2010: Michael Lee-Chin - Michael Lee-Chin, Executive Chairman and Chief Executive Officer, is ranked #8 in the August 2010 issue of Black Enterprise: The 40 most powerful African Americans in business-and how they shaped our world.

- July 9, 2010: Chris Wain-Lowe - Executive Vice President and Portfolio Manager at Portland Investment Counsel, expects sentiment toward financials to improve by the end of the year. "All the regulatory issues should be out in the open, and people can do their numbers and recognize where the trajectory of growth will come from," says Wain-Lowe

- June 17, 2010: Robert Almeida - Mr. Almeida comments on the merger of Sceptre Investment Counsel with privately owned Montreal-based Fiera Capital Inc.

- May 7, 2010: Chris Wain-Lowe - Nomura Holdings, Japan's largest brokerage, is embarking on a major global expansion. Chris Wain-Lowe of Portland Investment Counsel in Burlington, Ontario, who oversees his firm's position in Nomura, says the U.S. build-out is "culturally a very similar story to what Lehman was able to achieve in Asia."

- April 26, 2010: The Trust for the Americas announces its new board member, renowned Canadian business leader, Mr. Michael Lee-Chin. - "The Trust for the Americas, a non-profit affiliate of the Organization of American States (OAS), is pleased to formally announce its new board member, renowned Canadian business leader, Mr. Michael Lee-Chin. The Jamaican-born Chairman of Portland Holdings Inc., Mr Lee-Chin’s business accomplishments span various countries and numerous sectors."

- Monday, April 19, 2010: Chris Wain-Lowe and the American Advantage Fund - The Globe and Mail - “Long-term investors may look back two or three months from now, and possibly see this time as a “buying opportunity” among financials that have been dragged down by the headlines, they suggested."

- Friday, April 2, 2010: AIC American Advantage Fund - The Globe and Mail - “Financial services equity funds rose to the top of the performance heap in March after investor concerns over tough U.S. financial reform subsided and bank stocks in Canada also rallied strongly. The group rose an average of 6.1 per cent last month, led by AIC American Advantage with a gain of 7.9 per cent (11.8 per cent in its U.S.-dollar version). The BMO S&P/TSX Equal Weighted Banks Index exchanged-traded fund rose 7.4 per cent."

- March 2010: Black Enterprise Magazine: A feature article in Black Enterprise Magazine about "Mega-investor" Michael Lee-Chin's unique philosophy. "Mr. Lee-Chin says that sticking to his investing philosophy and identifying positive qualities within a particular company are keys to successful investing. Lee-Chin’s rationale for favoring asset management business? -- They’re in a strong, long-term growth industry driven by a growing and aging population’s desire to create wealth."

- Thursday, January 21, 2010: "Buy fund companies for RRSP investments" - Globe Investor "Confidence is returning for investors, and interest rates are incredibly low. You can tolerate 2-per-cent returns when everything else is going down." says Robert Almeida of Portland Investment Counsel. "DundeeWealth Inc. and AGF Management Ltd. should benefit because they have the highest exposure to equities among the larger firms, while DundeeWealth also has strong sales growth." he said.

- Wednesday, January 20, 2010: "Wealth management a winning bet: Lee-Chin" - Advisor's Edge Report - "My investing style can be defined by one word: understand. You buy things that you understand. That hasn't changed since 1987 and if you look at the composition of the Advantage Fund, 60% of the businesses remain in the wealth management space, and that is the business that I grew up on and understand." Michael Lee-Chin

- Friday, January 15, 2010: "Canadian leaders that rode the market's rise" - The Globe and Mail - “As the market started to rebound, assets under management went up,” said Robert Almeida, a manager at Portland Investment Counsel Inc. and who co-runs the AIC Advantage Funds. “The market started to recognize that, if you are in a recovering market, the outlook for asset managers is for earnings growth.” Robert Almeida

- December 1, 2009: London Free Press Interview with Michael Lee-Chin. He recommends India to savvy investors. Lee Chin said some of the most exciting new opportunities are in the booming economy of India. “It has a young population and a massive middle-class consumer market that is emerging.” He said India is a safer bet than China because it not as dependent on export markets. The AIC Advantage funds has recently invested in Infosys Technologies, an IT consulting firm based in India and the new port of Mundra on the Indian Ocean.

- December 2, 2009: Forbes Interview with Michael Lee-Chin. Michael Lee-Chin talks to Forbes about the U.S. dollar, Warren Buffett and investing for the long haul. "What this global economic crisis has highlighted for me is the absolute value of liquidity. My wealth came from growing businesses. I had wealth, but not liquidity. Basically I transferred illiquid shares of AIC for liquid shares of Manulife. Now I'm the biggest individual shareholder of Manulife."

- September 28, 2009: Michael Lee-Chin: Unshakable, Canadian Business Michael Lee-Chin persevered through seven years of losses and criticism before he finally sold the company he built. He wouldn't change a thing. Lee-Chin sits down with Canadian Business for a frank conversation. "I think the Advantage Fund is perfectly positioned as a business person would and has positioned it. The Advantage Fund, sir, has 60% of its portfolio invested in wealth management, because it’s the sweet spot in the financial services industry." Michael Lee-Chin

- October 21, 2009: James Cole, a Senior Vice-President of Portland Investment Counsel, Globe and Mail The Canadian retail sector is looking up as the economy begins to climb out of a recession and the jobs outlook improves. "People are selling the defence and buying offence," Mr. Cole said. "I'm going the other way."