Managing Wealth For You

Portland Investment Counsel Inc. is registered as a portfolio manager. This page describes the services that it provides you under this registration, as we manage your money for you, often referenced as being your ‘Discretionary Manager’. We work with you to understand your entire financial situation, which translates into providing the best possible portfolio solutions for the amount of money that you invest with us with ongoing updates to your financial situation as you remain invested. As we manage your money we apply fees for those services, summarized as:

| Asset Class | Flat Fee by Asset Class per annum |

|---|---|

| Exchange Traded Funds | 0.25% |

| Fixed Income | 0.45% |

| Other Equities and Instruments | 0.90% |

| Cash and Equivalents | 0.00% |

We don’t charge fees for simply holding your cash and will always provide you with notice should this fee structure change.

Should you choose to invest with Portland Investment Counsel Inc., your assets will be held with our custodian, NBIN Inc., a division of NBF Inc., which is an indirect, wholly owned subsidiary of National Bank of Canada. There are fees that NBIN Inc. will charge your account.

Please refer to the fee schedule located in your managed account agreement with us for a complete listing of the fees that are applicable.

Now, a bit more about us

We are no ordinary investment counsel. We are certainly smaller than the big bank-owned investment firms and deliberately located away from the ‘noise’ large investment firms tend to generate.

Based in Burlington, Ontario, our name comes from the birthplace of Michael Lee-Chin, our founder. Portland, with its capital town of Port Antonio, is a parish located on Jamaica’s northeast coast. It is one of the rural areas of Jamaica, containing part of the Blue Mountains, now famous for its rather special brand of coffee.

Wealth is generally created by business people, not by governments or central bankers. Although we believe that enlightened governments should provide social inclusion through healthcare and education, fight to reduce poverty and strive to provide an equitable path to opportunity for all, a country’s business people will generally hold the responsibility of wealth creation. At Portland, we are business professionals. We follow investment principles which guide our everyday actions. We have experience as investors, owners and operators of successful businesses. We understand that to invest successfully requires a sound intellectual framework, control of emotions and access to opportunities.

We believe that wealth is created by owning a few well-understood businesses which reside in long term growth industries, use other people’s money prudently and holding those businesses for the long run. With this in mind, we choose to invest in quality companies which consist of a number of factors, including: leadership by an owner/operator; concentrated and easily identifiable ownership with key stakeholders being personified in the company; authoritative and entrepreneurial management; low managerial turnover, symmetrically distributed risks/rewards; a clear focus on achieving long-term goals and growth; and valuation of the companies based on business fundamentals.

“We are excited about our investment approach and grateful for the opportunity to share it with you.”

Wealth can be created one investment decision at a time. As owners and operators of private businesses, we use our experience to build portfolios that we expect to withstand the test of time and allow compounding of wealth. Successful investing includes owning assets we understand. As such, our investment decisions are deliberate, taking care that quality opportunities are included in our portfolios. We continually persevere in our search for what we believe are quality businesses at fair prices. Our opportunity for success is broadened through our access to private securities and alternative strategies. For generations, successful institutions and affluent investors have achieved above average rates of return by utilizing an asset mix which combines traditional and private investments. We have endeavoured to leverage our investment approach by associating ourselves with other business professionals and eminent asset allocators, sharing access to such opportunities with our investors along the way.

Unashamedly, our bias is to invest your money alongside ours and other clients in Portland’s investment funds and private equity products. If you choose only to place a part of your wealth with us then we would always look first at your suitability to invest in the private and alternative investments we manage, assuming your residual wealth is being invested in more traditional ways (public equity and debt). Since we seek to invest in a few well-understood businesses rather than a more diversified approach, our results can be expected to be more concentrated and perhaps different from the general market over shorter periods of time, but we will invest based on our philosophy while understanding your needs and our desire to help make you wealthier.

Take a look at Portland’s Private Wealth team. We are a small group within Portland Investment Counsel Inc. who have made it our mission to create wealth for our investors, one investment decision at a time, one investment mandate at a time, one individual at a time. We are excited about the road ahead, grateful for the opportunity to share it with you, and are always happy to discuss.

Doing Well, by Doing Good

EUCALYPTUS PLANT NURSERY, APSD BIOMASS, GHANA, AREF

EUCALYPTUS PLANT NURSERY, APSD BIOMASS, GHANA, AREF COOPEGUANACASTE SOLAR PARK, COSTA RICA, MSEF I

COOPEGUANACASTE SOLAR PARK, COSTA RICA, MSEF I PANAMASATARA, INDIA (REAF)

PANAMASATARA, INDIA (REAF)At Portland, we believe that investing for the greater good is an element of the social contract that we all have with each other as members of society. Since launching the Portland Global Energy Efficiency and Renewable Energy Fund LP (“Portland GEEREF”) in 2013, we have been watching others follow similar commitments to impact investing. Portland GEEREF co-invested in a private equity and infrastructure fund of funds (Global Energy Efficiency and Renewable Energy Fund “GEEREF”) with the European Investment Fund, Germany, Norway as well as pension funds and endowment funds across the world. GEEREF seeks to provide access to sustainable energy and increase energy efficiency in developing countries and economies in transition. GEEREF’s portfolio is investing indirectly in 160 projects and in 2018 had reached an equivalent of over 1.6 million beneficiary households in at least 15 countries. GEEREF’s current projects eliminate 2.9 million tonnes of CO2 equivalent per annum and have created over 6,000 permanent and temporary jobs. Once GEEREF’s underlying projects are fully built, it is expected to improve access to approximately 12 million households annually in 24 countries with the largest number located in Africa, thereby expected to reduce about 8.2 million tonnes of carbon dioxide annually – an equivalent to taking about 1.6 million cars off the road. We are proud and delighted with Portland GEEREF and so have and will create more funds with similar socially conscious purposes.

The Illiquidity Discount1

We are no ordinary investment counsel.

-

Calculators

Why Private?

We’ve mentioned a few times our ability to offer private investments to our clients. But what exactly are the benefits of investing in private securities versus public securities? Allow us to explain.

Liquid assets are easy to convert into cash in a timely fashion without jeopardizing the asset’s selling price, as they can be quickly sold on the public markets. Illiquid assets, on the other hand, are more difficult to convert into cash due to various reasons including lock-up or hold periods. While liquid assets are easy to convert into cash, they might not have the same potential to grow as much as illiquid assets. In other words, liquid assets tend to cost more and so have limited price growth potential compared to illiquid assets, which tend to benefit from the opportunity to achieve higher returns due to an illiquidity discount.

Understanding Illiquidity Discount

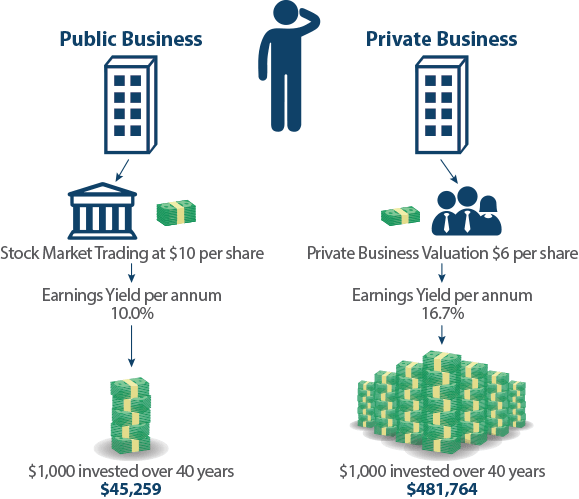

Imagine an investor decides to invest $1,000 in either Company A or Company B for 40 years. Both companies are identical in purpose but Company A is publicly traded and Company B is a private company. Imagine both firms have the same earnings of $1 per share. The value of Company A is available daily through the stock-market and is currently trading at a price of $10 per share. By comparison, Company B is valued by Business Valuators at $6 per share due to a 40% illiquidity discount.1 Therefore, Earnings Yield (calculated as earnings per share/price per share) for Company A is 10% per annum, but 16.7% per annum for Company B. $1,000 invested at 10% over 40 years will provide a future value of roughly $45,259 whereas $1,000 invested at 16.7% for 40 years will lead to roughly $481,764.2

Of course, we all need some readily accessible cash to meet unforeseen needs. Investing completely into illiquid assets would be irrational, however, depending on your situation, we believe it makes sense to invest some money into private investments. The earlier example works best for those of us who can invest over many years – forty years is better than four.

Subscribe to Portland

Subscribe and get information about events, products and updates emailed to you!

By Agreeing to fill out this form and Subscribe you Consent to receive, from time to time, articles, white papers, marketing materials, event invitations, seminar invitations, webcasts and other commercial electronic communications, from Portland Investment Counsel Inc., that we feel are timely, relevant and interesting - please provide your information and consent above. Your information will not be shared with any third parties.

Send a Comment

Your email address will not be published. Required fields are marked *

Your comment as been sent!

Over 75 years combined business and portfolio management experience. Our team has held CEO and Senior Executive positions in Canada and around the globe in various industries including: Banking, Wealth Management, Retail, Infrastructure etc. Our Portfolio Managers combine their extensive experience and judgement with in-depth research to make investments that are consistent with Portland Investment Counsel’s Investment Philosophy and the client’s objectives.

Dragos Berbecel has 20 years of experience, both as an investment professional and a business operator. He has devoted the last 10 years to being a student and practitioner of focused value investing. Dragos leverages more than a decade of experience as a marketing and sales executive working in diverse industries in Europe and North America.

Dragos has an MBA from University of British Columbia and is a CFA charter member. His investment methodology is in alignment with the Manager’s framework. Dragos brings a plethora of wealth management experience including 16 years with the Ontario Teachers’ Pension Plan where he held various positions, the last of which was Director, Global Equities.

Kyle received his Master of Finance degree from the Rotman School of Management at the University of Toronto and was awarded Dean’s List, First Class for being in the top 10 percent of students in the program. Kyle earned the Chartered Financial Analyst designation in 2018.

Joining the team in 2006, Dan is the Supervisor of Trading. He is also registered as an Associate Portfolio Manager and an Exempt Market Dealer-Dealing Representative. In addition to working with his clients, his responsibilities include overseeing the trade desk activities and operations in domestic and international equities, fixed income, foreign exchange and options. Dan works closely with the Portfolio Management team and focuses on the management and servicing of institutional and private wealth accounts. Prior to joining the firm, Dan had six years of experience at TD Securities and its affiliates.

With over 20 years of experience in the financial services industry, Steve began his career in investor trade settlement operations where he learned the administration side of the business. He later moved into a High Net Worth Trader/Portfolio Associate position where he gained client service experience and honed his skills at providing a top-notch client experience. Finally, Steve moved into the Institutional Trader post where he’s been active since 2006.